Or, It’s Time to Imagine a Future Beyond the Franchise

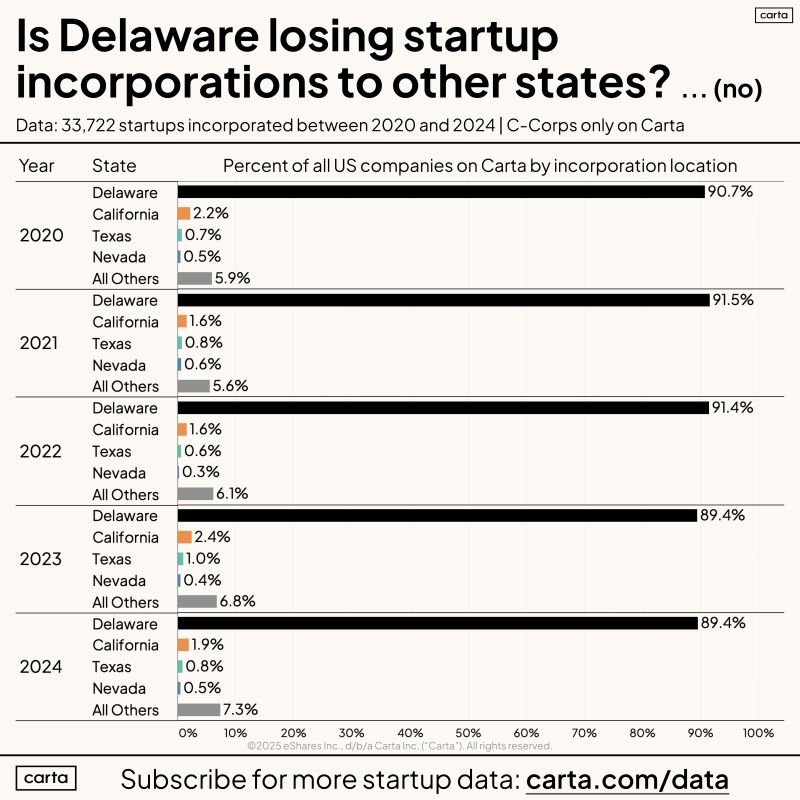

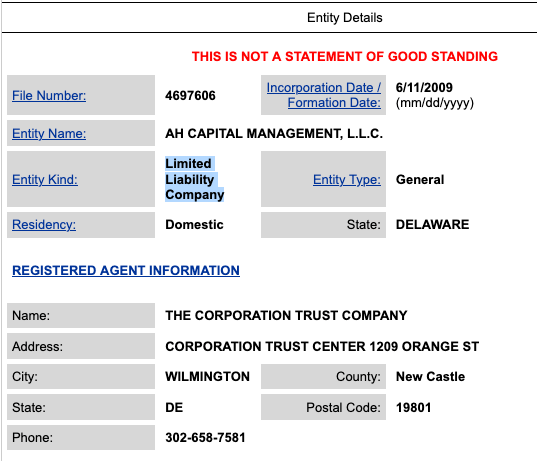

The Delaware franchise has been under serious attack for some time. Leading the charge are the richest men in the world, billionaire tech financiers, who see in Delaware law an outrageous affront to their power.

The conflict is something of a tragic irony for First State jurists. Emerging from the coddled confines of Palo Alto office parks, Manhattan penthouses, and group chats, these monied men understand themselves to be heroic innovators rather than well-placed directors of capital flows, men of history who are by dint of genetic excellence and genius effort elevated beyond the common clay. They therefore bristle at what a prior generation regarded as the final victory of Friedmanite ideology, viz., Delaware’s judge-made law that requires all business decisions to be made in favor of shareholder gain, and nothing else.

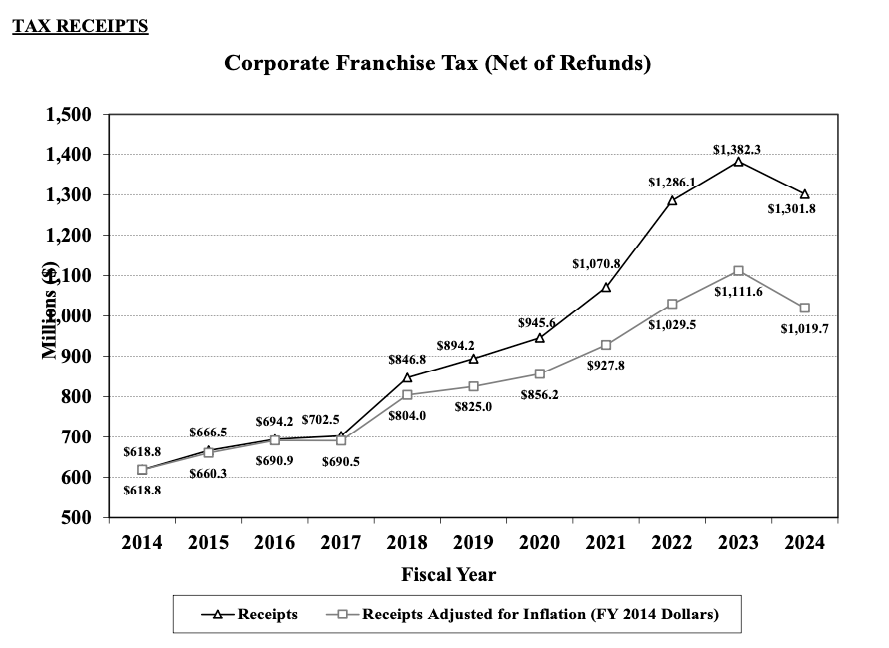

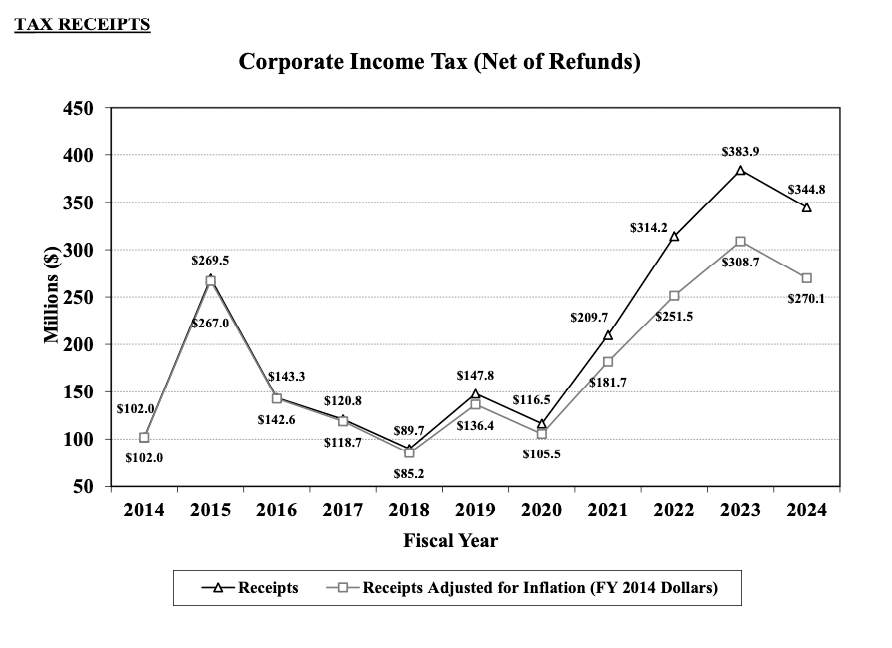

For anyone outside the cult of Gordon Gekko, it’s clear that the federalist jujitsu that’s made Delaware’s perverse insistence on shareholder primacy and short-term profit go global has been a disaster – for human health and flourishing, generally, and democracy in the United States, specifically. But for our modern robber barons, the application of judicial restraints – even for the purpose of maximizing shareholder gains! – has been as enraging and painful as a public flogging. In retaliation for this keenly felt but entirely imaginary insult, they and their servants in the corporate law world have fanned the flames for “DExit.” The goal, transparently and repeatedly announced, is to punish Delaware, and especially its judges, by denying the state the corporate franchise fees and escheats upon which it has grown dependent. They want to starve the horse they rode in on.

Delaware’s governors and legislators have responded to these attacks with abject capitulation. But since the root of the conflict lies in rich narcissists’ hurt feelings, appeasement has not worked. Instead, attacks have continued. In the past week, leaders of the world’s largest VC firm, known for hiring homicidal vigilantes, proudly declared they were “Leaving Delaware” and invited others to do likewise, in order to escape Delaware’s onerous bias “against technology startup founders and their boards.”

Leaving aside the bizarre dissembling involved with officers of an LLC claiming they will change the “state of its incorporation,” the conclusion that must be drawn from this latest tantrum is that the fuel for “DExit” is far from finished. True, the corporate stampede that SV billionaires have attempted to kickstart has not yet caught on. But given the power this cohort of corporate aristocrats wields – oceans of capital, vast media megaphones, and a keystone place in the revanchist coalition governing the United States – a future in which Delaware’s corporate franchise is crippled, or killed outright, seems a distinct possibility.

So what happens when the standing order of a state comes crashing down?

~

In 1818, the State of Connecticut adopted a new constitution, and disestablished the Congregational church. After almost two centuries of legally mandated taxpayer support, the state’s church was overthrown – out-muscled by a coalition of Democratic-Republican partisans and rival Protestant denominations, who took the opportunity of the Federalist Party’s decline to crack the central pillar of Connecticut’s “Standing Order,” and wedge in a measure of religious freedom in the bargain.

The war for disestablishment was fiercely fought for years. Lyman Beecher, a popular and ambitious Congregationalist minister, was among the leading anti-disestablishmentarians. In his early forties when the institutions that defined his life and successful career started to totter, he worked frantically to shore them up, organizing political supporters and leading evangelical revivals “with all [his] might” to salvage what he regarded as humanity’s last best hope for salvation.

Beecher worked until his “health and spirits began to fail,” but he and his co-religionists still lost – and fell into grief when they were beaten. Harriet Beecher Stowe, his daughter, remembered that when news of the key election loss arrived at their home, “a perfect wail arose.” Beecher himself recalled the period was “as dark a day as I ever saw” (quite a thing for a guy living in an era of high infant mortality to say).

However, in time, he changed his mind.

“I suffered what no tongue can tell for the best thing that ever happened to the State of Connecticut.” [emphasis in original] [1]

In describing disestablishment this way, Beecher didn’t mean that the state itself benefited, as a government. He meant that society as a whole did. Being thrown “wholly on their own resources and on God” increased ministers’ influence, he argued, by forcing their evangelizing to go to ground – to save souls through “voluntary efforts, societies, missions and revivals” rather than through coercive force or the trappings of wealth and power. Disestablishment, for Beecher, furthered God’s cause by making it more authentic, and thus more popular.

Beecher came to this perspective after a long life of successful (and controversial) evangelical work. He was also riding a tsunami of transformative evangelical fervor in the Second Great Awakening, a wave of dramatic cultural change with origins, energy, and effects that drew on waters far deeper and wider than any in the Nutmeg state.

Still, I think Beecher’s late-life observation is worth keeping in mind, particularly when considering changes in a state’s political economy that might seem apocalyptic. He saw the downfall of the Connecticut’s Standing Order, an establishment much sturdier and long-lived than any kind of Delaware Way, and lived to call it a blessing.

~

We live in times in which it is difficult to imagine the future. Or at least, difficult to envision latter days where a boot isn’t stamping on a human face – for ever.

And yet, change comes. As Ursula Le Guin explained, “[w]e live in capitalism. Its power seems inescapable; so did the divine right of kings.” In that moment, Le Guin was contemplating art amid Amazon’s growing monopoly, but she did so with a historical sense that stretched beyond Bezos’s horizons, and an anthropologist’s awareness of how all human societies, like human beings, are mortal.

Delaware’s corporate franchise is itself transitory. As Vice Chancellor J. Travis Laster has recently observed, “[f]or the first 120 years of Delaware’s existence, corporations were no more significant to Delaware than to any other state.”[3] Delaware, as a self-governing polity, has existed for a handful of years longer under its current corporate configuration than it has without it – but the years where franchise revenues were critical to state finances are many fewer than that. Delaware’s current political economy has a history – and it’s not a long one, nor inevitable.

That’s important to keep in mind today, when the power of the franchise seems both inescapable and irresistible. It’s a force that routinely turns politicians who ran (and wrote!) as progressives into staid corporate defenders, and constantly skews governing priorities toward ends that do substantial social harm, in Delaware and beyond. By setting up shop as the preeminent caterer for corporate whims, Delaware has caught the corporate “wolf by the ear,” and can neither function as a state without depending on its revenue, nor function as a representative democracy within that dependence.

In this sense, the tech billionaires’ revolt – like their intellectual ancestors’ rebellion for treason in defense of slavery – could be the rare kind of creative destruction that allows a greater freedom for the many, rather than exploitation by the few.

But if Delaware is to get to that outcome, some study and planning for that future is needed, now. This year, the legislature has invested in research to maintain the status quo, but a serious effort for a truly forward-thinking and realistic agenda will require something different. [4]

Some questions Delaware must answer:

- What sources do similarly small states rely on for revenue? Rhode Island persists, without a franchise; could Delaware?

- How much could a sales tax bring in – and what rate would maximize revenue while minimizing the burden on the least able to afford it? What kind of transition procedure would be least disruptive?

- Delaware Democrats recently quashed an effort to update personal income tax brackets to make them more equitable. Could a successful effort capture sufficient revenue from high-income earners to make up for a portion of franchise losses? (Ironically, in this case the actors most responsible for the “DExit” flight – corporate defense lawyers – may be the most directly able to bear new taxes to make up its loss).

- The Delaware State Bar claims that corporate law services bring in billions, but the industry’s economic impact has not been rigorously studied by independent researchers.[5] What is the industry’s true value, and what effect will the decline and loss of the franchise have on employment, and public revenues? If billionaires and tech corporations abandon the state, but LLCs and other business entities continue to be formed here, what effect will that have on court usage and lawyers’ employment?

- Finally, it would be well to expand our historical understanding of the franchise. Shockingly little is known about the actual operations of the franchise in the past, or its development, as a functioning support for government. When did Delaware become dependent on the corporate franchise for revenue – and how did that process unfold? Recent research suggests the oft-repeated story, that Delaware’s dominance of the corporate charter market started with New Jersey’s fall in 1911, has a severe evidence problem.[6] So when did things start to change, who drove it, and with what consequences? A firmer grasp of the facts of what happened would, I suspect, change our ideas about what is possible.

The life or death of the corporate franchise is not a matter within Delawareans’ control. That, in itself, is a reason to want to diversify the state’s revenue sources. But even if First State politicos are unwilling to quit the gravy train cold turkey, their dealers seem ready to cut off the supply, nonconsensually.

In either case, its time for Delawareans to start thinking hard about what a future without the franchise might mean – the problems it would bring, but also the opportunities. Because stasis isn’t just unlikely; it’s impossible.

—–

[1] Lyman Beecher, Autobiography of Lyman Beecher, ed. Barbara M. Cross (Cambridge: Belknap Press of Harvard University Press, 1961), 1: 252-253

[2] Le Guin, as quoted in Rachel Arons, “‘We Will Need Writers Who Can Remember Freedom’: Ursula Le Guin and Last Night’s N.B.A.s,” The New Yorker, November 20, 2014, https://www.newyorker.com/books/page-turner/national-book-awards-ursula-le-guin.

[3] J. Travis Laster, “An Eras Tour Of Delaware Corporate Law,” Journal of Corporation Law 50, no. 4 (July 2, 2025): 1189–1263, https://jcl.law.uiowa.edu/articles/2025/07/eras-tour-delaware-corporate-law. Laster, as a jurist, is rather looser with chronology than any persnickety historian would be: Delaware’s period of “normal” corporate engagement lasted 123 years, while its era of eager corporate solicitation has lasted 126 (so far). That said, the article is a valuable exercise in periodizing legal history, and offers readers many claims worthy of further investigation and research.

[4] In it’s most recent session, the Delaware General Assembly reserved $200k for research into the “corporate franchise,” and sponsored a resolution directing the “AI Commission” and the Secretary of State to study AI’s uses for “corporate governance.” It seems unlikely that either effort will result in measures that improve democratic outcomes. See: HB 230, “An Act Making Appropriation for Certain Grants-in-Aid,” July 1, 2025, Section 19; and HJR 7 w HA 1, “Directing the Artificial Intelligence Commission,” June 30, 2025.

[5] Paul Larson, William Latham, and Kenneth Lewis, “The Contributions of the Legal Industry to the Delaware Economy” (Delaware State Bar Association, June 2019), https://www.morrisnichols.com/media/news/15068_Delaware%20Bar%20Study_Legal%20Industry%20Contributions%20to%20Delaware%20Economy_06-2019.pdf.

[6] Andrew Verstein, “The Corporate Census,” SSRN Scholarly Paper (Rochester, NY: Social Science Research Network, February 25, 2025), https://papers.ssrn.com/abstract=5154952

![Louis Dalrymple, “Uncle Sam’s Dismal Swamp,” Puck, November 15, 1893, https://www.loc.gov/pictures/resource/ppmsca.29155. Print shows Uncle Sam sitting on a log in a swamp labeled "Spoils System" from which snakes labeled "Quayism", "Bardsleyism", and "Tannerism", and noxious fumes rise in the form of shades labeled "Raumism - Pension Swindler, Crokerism, McLaughlinism, Tweedism, Prendergast - Political Assassin, [and] Guiteau - Political Assassin". Also shown among the tree roots is Charles A. Dana.](https://daelnorwood.com/wp-content/uploads/2025/02/dismalswampcrop.png?w=839)