Or, Why Are Delaware’s Leaders Huffing Musk’s Swamp Gas?

![Louis Dalrymple, “Uncle Sam’s Dismal Swamp,” Puck, November 15, 1893, https://www.loc.gov/pictures/resource/ppmsca.29155. Print shows Uncle Sam sitting on a log in a swamp labeled "Spoils System" from which snakes labeled "Quayism", "Bardsleyism", and "Tannerism", and noxious fumes rise in the form of shades labeled "Raumism - Pension Swindler, Crokerism, McLaughlinism, Tweedism, Prendergast - Political Assassin, [and] Guiteau - Political Assassin". Also shown among the tree roots is Charles A. Dana.](https://daelnorwood.com/wp-content/uploads/2025/02/dismalswampcrop.png?w=839)

The state government of Delaware is in the process of amending its corporate law to benefit Elon Musk, personally, and people like Elon Musk – oligarchic managers who use their control of corporate boards to loot regular investors – more generally. The mechanism is Senate Bill 21, legislation that was drafted by Elon Musk’s attorneys, a fact confirmed by the bill’s filer, Senator Bryan Townsend.

The rationale for this rash action is fear: fear that if Delaware does not extinguish judicial independence to better fit Musk’s perverse desires, Delaware will lose critical revenues, as Musk leads corporations to “DExit,” or registering in other states, because of Chancery Court decisions that since 2022 have supposedly upset the balance of power between shareholders and corporate managers.

The data does not support the panicked narrative that SB 21’s supporters have been promoting, however. That narrative seems to be a product of Musk, and his paid agents, spreading misinformation like a miasma across the state.

Delaware’s Corporate Franchise is a Volume Business

Delaware benefits in several ways from having outside corporations registered here. The most valuable benefit is revenues from the “corporate franchise tax.” This is a fee that corporations headquartered outside the state provide Delaware for the “privilege of being incorporated in Delaware.” (Fiscal Notebook, 2024 ed, p. 108). In recent years, the corporate franchise tax, alone, has provided ~20% of total state revenues, or about 1.2 billion dollars. (Personal income tax, paid by human people, provides 33% of the total state revenue). (Fiscal Notebook, 2024 Ed, p. 32).

The critical thing to know about the corporate franchise tax is that it is not an income tax: it’s a set of tiered fees, assessed based on a corporation’s total number of authorized shares – but with a max payment cap of $250,000.

In other words, Delaware is in a volume business, not a value business. Delaware has – or rather, should have – an interest in appealing to the largest number of corporate registrants, not the wealthiest billionaires. That’s a critical point, because the interests of most corporations – and most investors – do not align much at all with the desires of oligarchs like Elon Musk. If it wants revenue, Delaware shouldn’t be catering to the tiny cohort of vampires.

Back to Delaware politicians’ panic: you would think if the corporate franchise tax revenue is indeed in peril – if the “DExit” movement is real, and not just a propaganda hallucination – then there would be some data to support that claim.

Alas for Musk et al., and their well-paid agents, three data points suggest the opposite is true.

1) Startups Continue to Choose Delaware

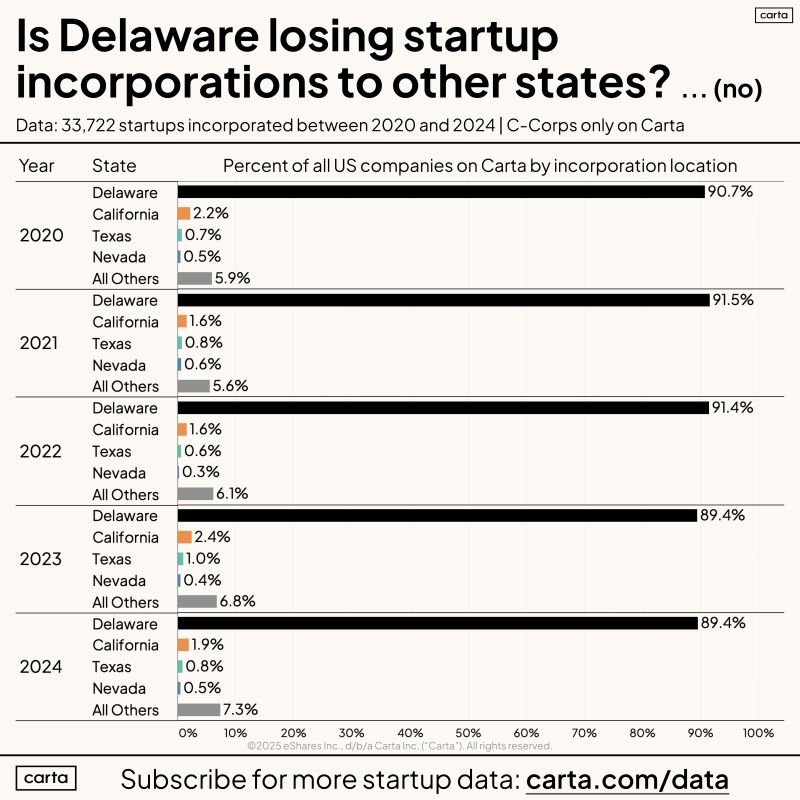

Peter Walker, “head of insight” at Silicon Valley data infrastructure firm Carta, recently shared a chart from his company’s private dataset demonstrating that 90% of startup C-Corps are domiciled in Delaware – a percentage that has “barely shifted in the last 5 years.” Including in 2024.

Source: Peter Walker, “Is Delaware Losing Startup Incorporations to Other States? … (No),” LinkedIn (blog), February 21, 2025, https://www.linkedin.com/feed/update/urn:li:activity:7298753740558254080/.

2) The Number of Corporations Filing Franchise Taxes Keeps Going Up

The most recent public figures show that 309,911 firms filed franchise tax payments in FY 2024 – an increase that continues the unbroken upward trend of the last decade, before the recent Chancery Court decisions, and then through and beyond them.

Source: Annual Comprehensive Financial Report, FY 2024 (Delaware Department of Finance, Division of Accounting, 2024), p.206

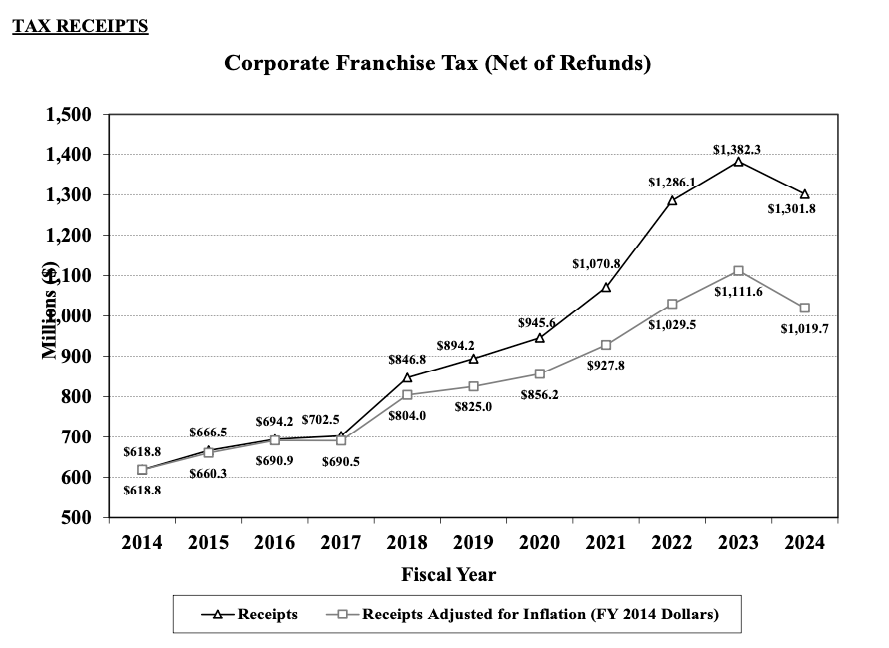

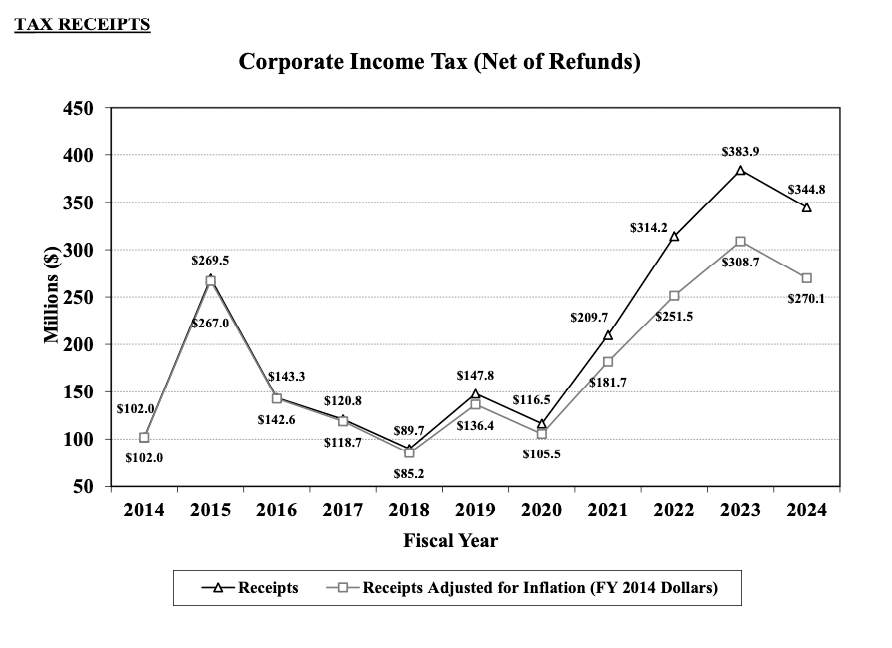

Now, total corporate franchise tax receipts have dipped, somewhat, from 2023 to 2024. But they have done so following the same patterns as the Corporate Income Tax.

Source: “Tax Receipts: Corporate Franchise Tax,” and “Tax Receipts: Corporate Income Tax,” in Fiscal Notebook FY 2024 ed., pp. 109, 115

That suggests to me that the cause lies in macroeconomic conditions – unemployment, inflation – rather than anything to do with Delaware’s legal regime. (Corporations paying income tax here do business here; they can’t exit as easily as paper registrants, and have less incentive to do so).

3) DEFAC Forecasts Steady Corporate Franchise Tax Receipts

Since 1977, Delaware’s state government has relied on the Delaware Economic & Financial Advisory Council, or DEFAC, for economic forecasts. DEFAC meets quarterly to assess data, and issue guidance – guidance that the General Assembly usually regards as binding on legislation.

At the December meeting, DEFAC forecasts steady franchise revenues for FY 2025, 2026, and 2027. That is consistent with economic indicators – at least, prior to Musk’s installation as co-president – and suggests this expert body saw no threat in the data of the sort SB 21’s draftees were already hallucinating.

Musk’s Pungent Miasma is Not Reality

In short, private and public data sources agree: there is no observable decline in incorporations in Delaware, and no evidence that “DExit” is occurring in response to Chancery Court rulings. Further, the advisors specifically tasked with forecasting future franchise tax revenues – that is, a body of people mostly not employed by Elon Musk – do not see evidence for dramatic change.

An alternate explanation does fit the data better, though. Elon Musk’s lawyers drafted SB 21 to benefit their oligarchic clients, not Delaware. Musk’s paid agents are breathing the bad vibe fumes they want to see in the world into existence. The odor of panic they’ve wafted into lawmaker’s nostrils is thus a miasma, in the classic sense: unhealhy and unpleasant air, produced as the unpleasant exhalation of rot and corruption, that causes feverish illness.

Delaware’s leaders should not radically revise our laws, and gut a valuable franchise, on the basis of huffing Musk’s swamp gas.

———-

Header Image source: Louis Dalrymple, “Uncle Sam’s Dismal Swamp,” Puck, November 15, 1893, Library of Congress, https://www.loc.gov/pictures/resource/ppmsca.29155.

Data Sources

Note: while by statute, the heads of Delaware’s state agencies are supposed to provide public reports on things like the total number of corporations registered here, and revenues derived from them, in practice Delaware state government is … uninterested in transparency. Opacity is part of the value Delaware provides, apparently.

The upshot is that basic data, and foundational statistics, are often hard to get, and difficult to parse using normal methods even when located. Still, while our state government officials are intentionally(?) incompetent at communicating to the public, they have not shirked their duties completely; there are sources worth your time & examination.

Delaware Department of Finance, Division of Accounting, Annual Comprehensive Financial Report, FY 2024, https://accountingfiles.delaware.gov/docs/2024acfr.pdf.

While this report is not linked on the DE Finance Department’s page, you can find it at that URL. An annual report, it offers a wealth of up-to-date statistics on the fiscal situation of the government of Delaware, including revenues and expenditures, as well as detailed supplemental information on specific taxes, fees, pension contributions, bond obligations, and subsidiary agencies.

Delaware Fiscal Notebook: 2024 Edition (Delaware Department of Finance, 2024), https://financefiles.delaware.gov/Fiscal_Notebook/2024/2024-Fiscal-Notebook-Combined.pdf. (aka Fiscal Notebook, 2024 ed)

The fiscal notebook is a rehashing of much of what is in the ACFR, but summarized and more richly contextualized look at the state budget, with historical data and legislative histories. If you want to know when the corporate income tax changed, and under what legislation, the Fiscal Notebook is your guide. It has some charmingly 1990s graphic design, as well. Prior reports are available here.

Delaware Economic & Financial Advisory Council (DEFAC), https://finance.delaware.gov/financial-reports/defac-revenue-forecast/

DEFAC posts cryptic briefing books and terse meeting minutes, grouped by date, on this page. If you dig far enough, you can find their predictions; and if you want a bit of fun, take a look at how far off they were in their predictions (usually they underestimate revenues by quite a bit, and overestimate the cost of expenditures; there appears to be a spirally structural austerity built into their models, assuming any models actually exist beyond intuition).

Delaware Division of Corporations, https://corp.delaware.gov/

In theory, under the law, this page should contain the division’s up-to-date annual reports, detailing numbers of business entities registered in Delaware, and other pertinent information. In practice, this website is a wasteland.

3 thoughts on “The Data Does Not Support the Narrative”